News and Product Updates

Scenario Analysis

Feb 21, 2023

Featured Post

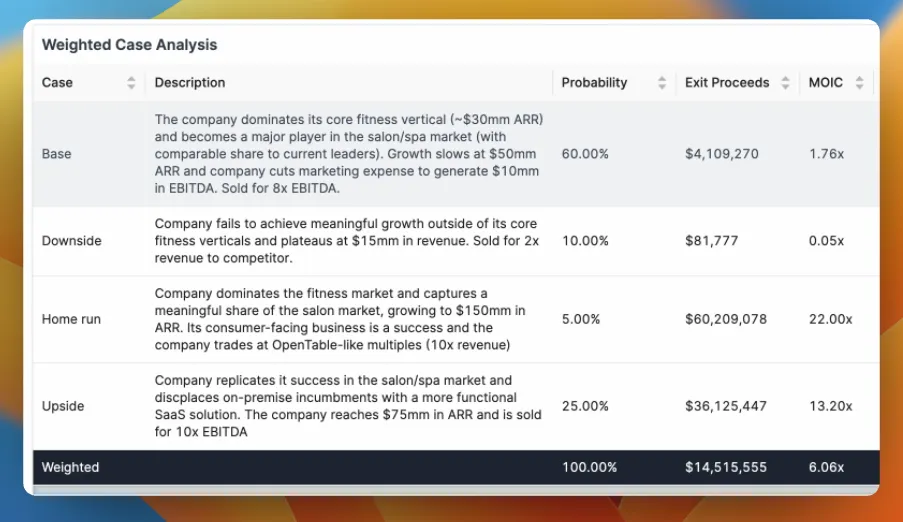

Scenario analysis is a common venture methodology to quantify investment risks. This involves building multiple exit outcomes with associated probabilities and calculating a probability-weighted return over a specified time period.

Introducing Cash Planning Module

Feb 13, 2023

Featured Post

Starting today, Tactyc has a new Cash Planning module to estimate capital requirement for the fund over a specified time period.

Solving Liquidation Preferences in Tactyc

Dec 1, 2022

Featured Post

Liquidation preferences (“liq prefs”) has been one of the most requested features since the launch of Tactyc. It took us a long time to solve this given the complexities involved.

Leveling up on MOIC Analysis

Nov 25, 2022

Featured Post

Why MOICs are more than just a reporting metric. In fact, they can be a very useful planning metric, especially for reserve deployment.

Leveling up on Return the Fund Analysis

Nov 16, 2022

Featured Post

Return the Fund is a common analysis managers undertake when evaluating venture deals. This involves calculating a Return the Fund metric i.e. the aggregate valuation a company needs to achieve in order to pay back the entire fund. A "Fund Returner" is a single deal that achieves this threshold - and while rare, deals like these are critical given the Power Law nature in VC.

Automatic Pro-Rata Reserves

Nov 7, 2022

Featured Post

Return the Fund is a common analysis managers undertake when evaluating venture deals. This involves calculating a Return the Fund metric i.e. the aggregate valuation a company needs to achieve in order to pay back the entire fund. A "Fund Returner" is a single deal that achieves this threshold - and while rare, deals like these are critical given the Power Law nature in VC.

New KPI Manager Features

Oct 31, 2022

Featured Post

New features around tracking and managing qualitative KPI metrics and internal fund comments

Introducing Multi-Currency Support

Oct 24, 2022

Featured Post

One of Tactyc's most commonly requested features is the ability to manage investments in different currencies. Starting today, Tactyc supports all of the above. You can define and manage the currency of an investment at the round level

KPI Manager Upgrades

Oct 18, 2022

Featured Post

We've made a few upgrades to Tactyc's KPI Manager module to improve user experience, increase flexibility and reduce the time spent in creating and managing portfolio company Index.

Advanced MOIC Analysis

Oct 10, 2022

Featured Post

MOICs are the most common indicator for evaluating investment performance. Depending on the question a manager is trying to answer, these MOIC calculations can become quite complex. Tactyc automatically calculates 7 different MOICs for each investment.

First Republic Webinar on Portfolio Construction Models

Oct 1, 2022

Blog

First Republic Bank recently organized a panel of experts to discuss the role and construction of portfolio allocation models, the latest real-world modeling insights, and identification of modeling best practices and common errors. The discussion was directed to First Republic’s growing community of venture CFOs and GPs. This document highlights the key points made by panelists.

Secrets of the Data-Driven Fund Manager

Nov, 2021

Blog

Over the past few months at Tactyc, we have surveyed various data-driven venture managers to see how they create and manage their fund forecast models. Does their success lie in access to proprietary data? Superior quantitative methodologies? Surprisingly, the answer turned out to be simple — they all use a powerful analytical workflow that creates a feedback loop enabling them to constantly course-correct their fund.

Advanced Portfolio Insights

Oct 3, 2022

Featured Post

Starting today, Tactyc offers a new Portfolio Composition insights module (under the Insights section) that lets managers answer these easily answer questions on their portfolio contribution and performance.